![]()

Around 90 percent of world trade is carried by the 70,000 or so vessels that make up the international shipping industry. Fuel is the number-one expenditure for each and every one of these ships. It accounts for between 30-40 percent of the cost of running a cruise ship and between 50-60 percent for most merchant vessels. Reducing fuel consumption by just 1 percent can mean an annual saving of $50,000 for a mid-sized bulk carrier and $300,000 a year for a large container ship. Marine fuel optimization provides a major incentive for ship owners and operators to be competitive in their market. The global marine shipping sector is responsible for approximately 1.5 percent of global greenhouse gas emissions from anthropogenic sources.

Under business-as-usual conditions, emissions from the global shipping fleet are expected to double by 2050. Shipping’s greenhouse gas emissions could be curtailed through changes in operational practices, improving the fuel efficiency of ships, and burning lower-carbon fuels. Combined together, these changes could reduce shipping emissions by 62 percent below business-as-usual projections in 2050. This would mean emissions would stay at roughly current levels despite large increases in shipping volume by mid-century.

The international dimension of global shipping complicates policy efforts to reduce emissions. Working with and through transnational actors will be an essential step to forging meaningful, global regulations. The financial cost drivers overlap with the environmental considerations as the economic costs for maintaining the existing ‘base case’ for ship fuels is continuously deteriorating under more stringent environmental regulations. Consequently, the shipping business is forecasted to grow, but changes in fuel efficiency and regulatory measures will impact existing value chains and force existing and new players into new business models to thrive in the future.

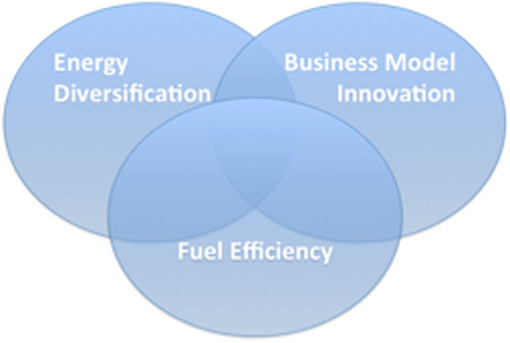

Based on an assessment of the World Energy Issues Monitor 2014, energy efficiency is the highest impact energy action item facing energy leaders today. Business model innovation in combination with technology innovation creates more competitive differentiation than technology innovation alone. Both on the supply as well on the demand side, increasing fuel diversification offers opportunities for new customer value propositions and new value chains. In combination, the three drivers in this nexus offer new business model opportunities for the industry.

The nexus of energy diversification, business model innovation and fuel efficiency to be applied in the business area of marine fuels

Seven of these opportunities have been identified and ranked on the following criteria:

- Ability to upscale and replicate

- Enabling synergies with existing fuel supply businesses

- Creating differentiation in the marine fuels market

- Leveraging on existing infrastructure and knowhow

- Offering quick pay-out against limited capital requirements

- Providing a platform and learning for further business model innovation opportunities

The seven opportunities are:

|

Opportunities

|

Ranking |

| 1. |

Fleet fuel efficiency performance management and ship tailored fuels

|

2 |

| 2. |

LNG fuel optimization and setting the LNG fuel standard, ‘matching’ of LNG and ship-engine specifications

|

1 |

| 3. |

Deliver a Miles/USD fuel service to customers using data analytics

|

6 |

| 4. |

“GE model” in partnership with ship-engine manufacturers, to provide a full propulsion and onboard energy performance service (engine load x hours)

|

7 |

| 5. |

Create and sell PowerFuels by repurposing ‘overflow’ of renewable capacity

|

5 |

| 6. |

Dual, hybrid and battery power services, combined with data analytics to optimise performance

|

3 |

| 7. |

Integrated electrical, mono-carbon and hydrogen energy system modelling to identify, create and capitalize on critical business value opportunities

|

4 |

Finally, the analysis offers some thoughts on how to further develop these business model innovation opportunities in the context of existing businesses.

Our main learning point from this study is that in order to thrive in the future, Oil & Gas companies need to upgrade their value proposition from selling more carbon fuel volumes to selling more ton-miles in the marine transportation sector.

Let us know your ideas on improving fuel efficiency and reducing emissions in the maritime sector.